hedge-fund.io

Snippets

|

Snippets are works in progress and so ask questions rather than attempt to provide answers (yet). The year so far in the Nasdaq 1001 and Nvidia earnings - 25 Feb 2026

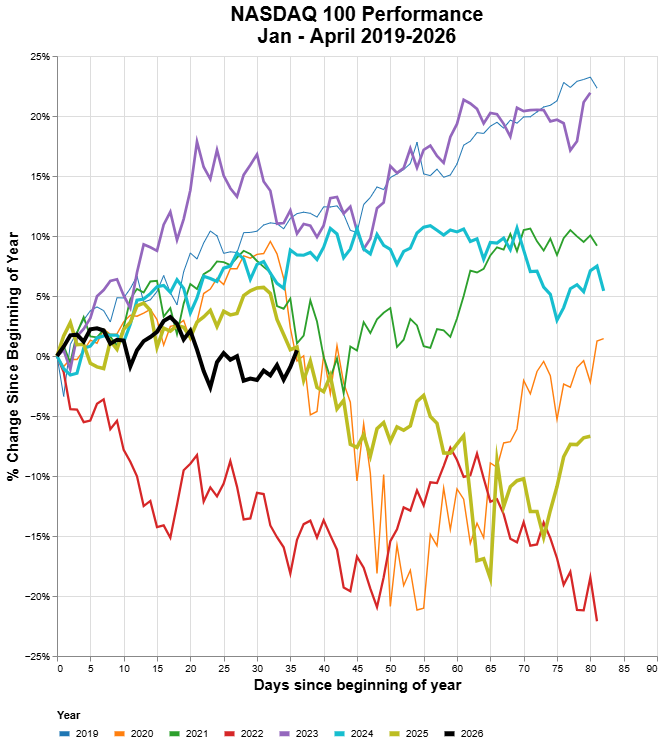

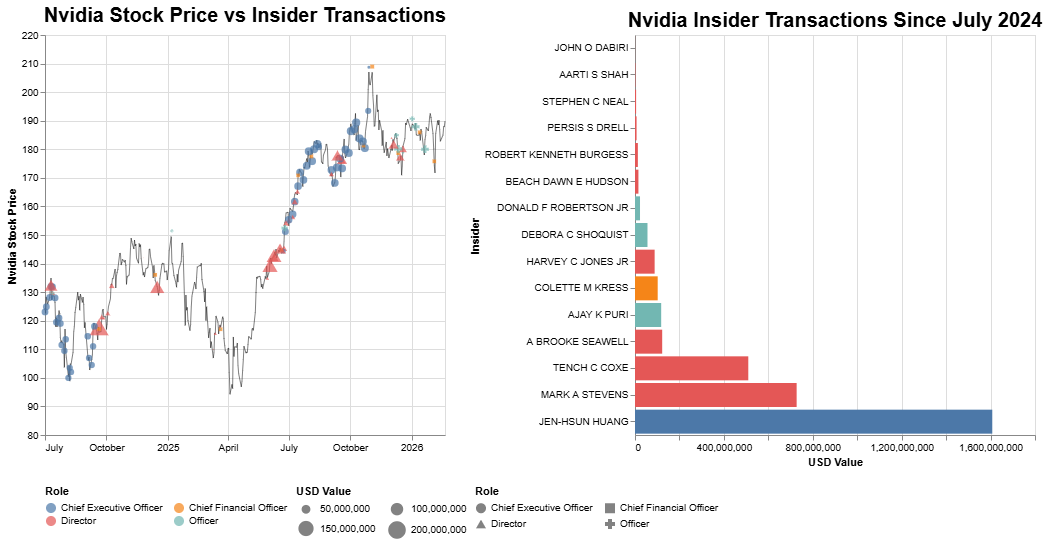

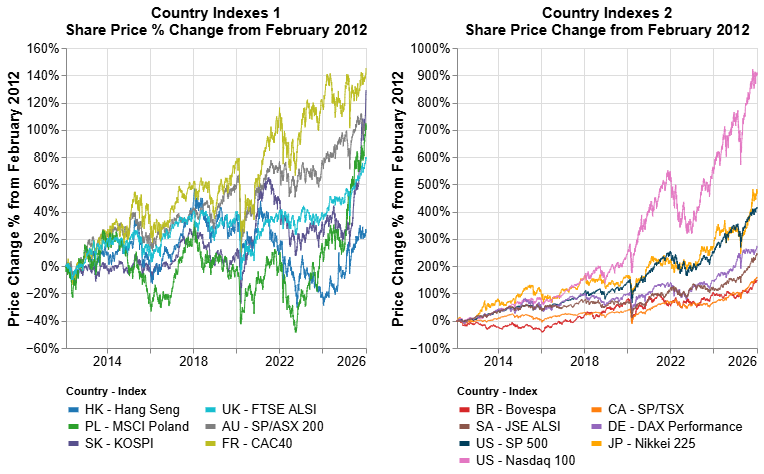

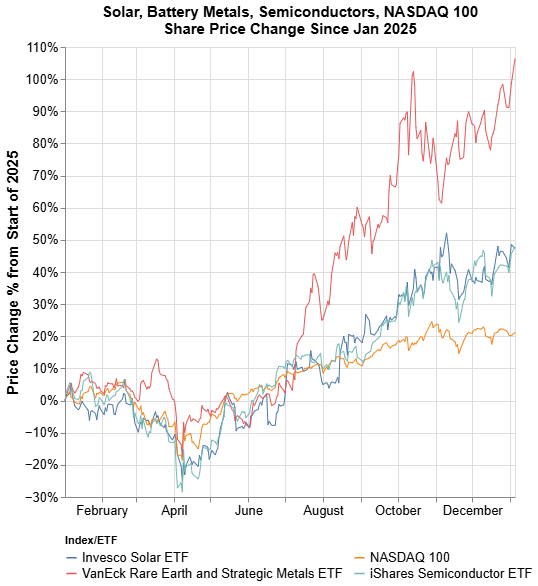

1Stock price data fromYahoo! Finance It feels like we’ve had a tumultuous start to the year in financial markets. In reality, this is the least-trending environment we’ve had since at least 2019. The Nasdaq 100 is essentially flat, up 0.5%, year-to-date. And yet we’ve seen the SaaSpocalypse, tariff tensions, extraordinary volatility in commodity prices, record one-day flows for several ETFs, and significant geopolitical posturing. We suspect, however, that when one looks underneath the hood you’ll find 1) dramatic within-index volatility and 2) higher intraday volatility. The latter is ultimately where option-sellers tend to make more money - relatively elevated (but contained) implied volatility means that options are expensive, but low realised volatility, especially for certain timeframes, means that options expire out of the money. In short, the market thus far has been great for 1) buy-and-hold index investors, 2) market makers. And far less so for punters betting on large outsized moves. Where we go from here is anyone’s guess but it seems bizarre that after all this intraday volatility, we’re not only flat 2 months into the year but we’re crossing the 0-threshold as we did in 2020, 2021 and 2025. Nvidia Q4 2025 Earnings As far as Nvidia earnings were concerned - our “concerning case”, in which income was elevated but revenue or margins were worse than expected, did not come to pass. However the FT cites their $43 billion in income without referencing the fact that it was boosted by $5.3 billion from realised and unrealised gains in their equity portfolio. Either they need to continue to show such gains on their equity portfolio (to put it in perspective - the whole of Jane Street generated less income than that from their trading activities in Q3 2025) or their net income growth will stall. And it may become clear how much the market cares about profit growth, rather than just revenue growth. At the risk of banging on about it, we emphasise again the similarity between Q4 2021 Amazon and Q4 2025 Nvidia - insofar as investment-related income made up a significant part of their net income. Data is the moat Somewhat unrelated we will tentatively take the win for citing Circle Internet’s prospects late last night - at last count it was trading up nearly 33%, the overall crypto market up over 10% and various other crypto companies up significantly. It is worth some caution here in that stablecoin legislation, even if passed, will only come into effect several months from now. Finally we also celebrate (possibly prematurely) a recent 20% gain in another holding Thomson Reuters (TR), recovering nearly all of the February declines. We previously covered the possibility of hyperscaler activities driving traditional media higher through licensing and partnership deals and we expanded this view to encompass a broader notion - that of data being the ultimate “moat”. Tae Kim made the point that TR was the only place to get Westlaw data. Further to this point we’ve been thinking about whether the hyperscalers really can (or even want to) disrupt SaaS entirely or whether it would make more sense for them to partner directly with these companies. We think the latter is more likely and as a result we’re starting to wonder whether the death of SaaS, much like that of the dollar, has been greatly exaggerated. Part of the reason we believe this is that in the extreme, a company with sufficiently smart and confident people ultimately takes on some of the qualities of a hedge fund (they become traders or investors, effectively). That is, these companies will likely increasingly take equity stakes in the companies they may disrupt, or which may disrupt them. And then the smartest of these people will go on to found companies in the space their trading activity has identified as being the source of future growth (we're thinking of Jeff Bezos leaving DE Shaw to start Amazon and more recently Liang Wenfeng, co-founder of Chinese hedge fund High-Flyer, who also started DeepSeek) Nvidia1 and Stablecoins (briefly) - 24 Feb 2026

1Stock price and insder data from Yahoo! Finance Nvidia announces Q4 2025 earnings tomorrow night after the closing bell. And there is a sense that, again, the GPU-maker is carrying the US financial market, and the global economy, on its shoulders. Nvidia has tended to beat, and its share price has tended to go up after earnings. And the fact that its share price is barely 4% off the highs from October 2025 shows that Nvidia tends to go up, period. But where are the potential sources of beating expectations? We’ll focus on their equity investments. LSEG data suggests Wall Street expects Nvidia quarterly profit to grow 62%. Eyes will be on the gross margin, on guidance and perhaps in particular on capital expenditure plans. We’re going to be looking for a very particular scenario - where net income or comprehensive income, and earnings per share, are higher than expected, but revenue, gross margins, and/or guidance disappoints. The reason for that is twofold - 1) Nvidia is likely to show some impressive unrealised (and potentially realised) gains on its $13 billion equity portfolio which might juice the numbers, and 2) if that happens, we recall the Q4 2021 Amazon earnings event in which their windfall in the Rivian IPO dramatically boosted their earnings.. Nvidia faces an interesting incentive - announcing an investment from Nvidia tends to impact a company’s stock positively. The major source of potential unrealised gain is of course Intec, where Nvidia’s shareholding gained approximately $3 billion during Q4 2025. If treated as profit, this could easily represent 7-10% of Nvidia’s pre-tax income in that quarter. And, perhaps, the impact that could have on e.g. an earnings per share beat might be worth (at least temporarily) much more than $3 billion in market capitalisation. If this is indeed the case (if earnings beat expectations in part because of investment-related income) we wouldn’t be surprised if Nvidia ramped up its buying and investing spree. Witness, Nvidia the hedge fund. Stablecoins A lot has happened in the last week around stablecoins and payments:

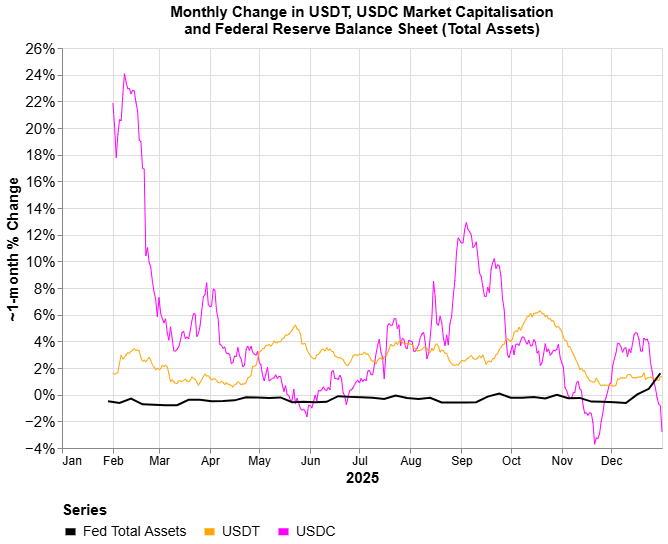

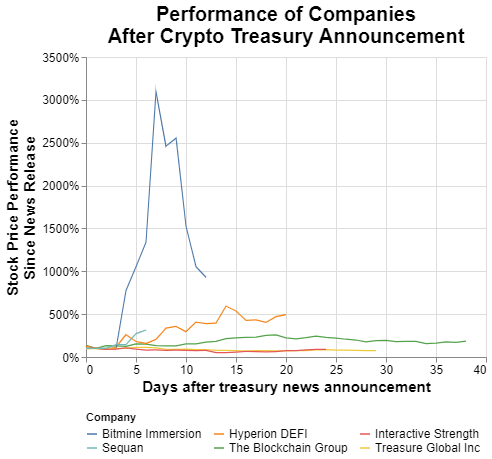

There’s a fair amount to unpack here and we’ll do so later this week. In the meantime we are debating this - a surge in cryptocurrency prices, triggered by regulatory clarity and/or a significant surge in stablecoin demand/volumes, could potentially push the broader equity market higher. We have a position in Circle Internet Group, the second largest stablecoin issuer (USDC), which also reports earnings tomorrow. In short, a highly transparent and “American made” complement (or substitute) to Tether could be significantly undervalued at the moment (although this is crucially sensitive to the broader regulatory environment and in what form legislation under consideration might pass in the US). Which companies1 could gain from Supreme Court Striking Down Tariffs2? - 19 Feb 2026

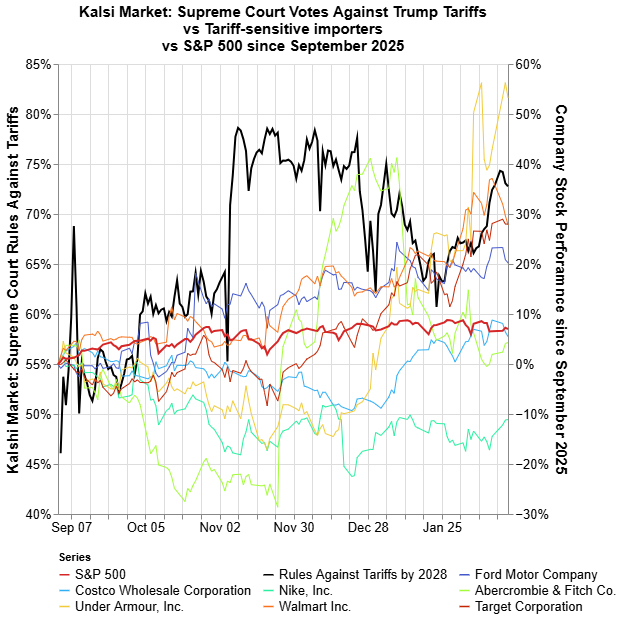

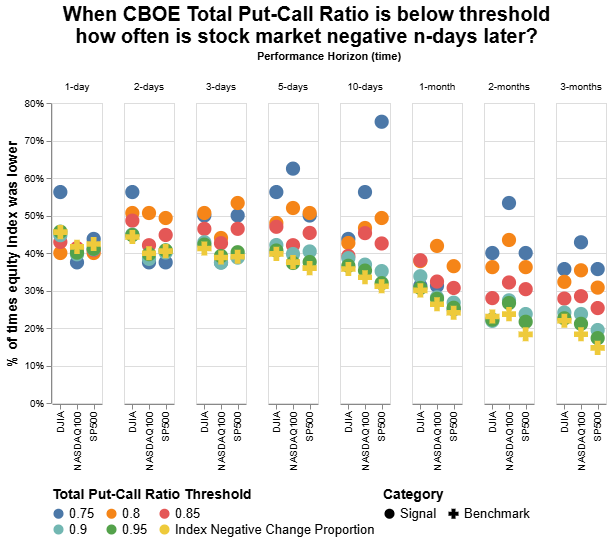

1Stock price data from Yahoo! Finance 2Prediction market data adapted from Kalshi Tomorrow the US supreme court could rule on the legality of President Trump’s tariffs. CBOE put-call ratios over the last week have spiked, suggesting market participants have been shorting equities or trying to hedge against a drop. Odds on Kalshi suggest that the supreme court is going to rule against the tariffs. If that happens tomorrow, there is a further question regarding whether 1) the tariffs should be refunded and 2) whether the Trump administration will find another way to reinstate levies. As far as market impacts are concerned there seems to be some consensus that the tariffs getting struck down would be good for stocks and could lead to a reduction in uncertainty. That seems like an oversimplification - if they get struck down, it seems likely that the Trump administration would respond with unexpected policy measures. What’s more, they have recently emphasised the record high levels of the market, and if the tariffs are struck down this could provide a handy scapegoat for any drop in equity prices, including for any of the administration's next policy responses that cause a drop in equities. In terms of specific equities which might benefit - there are a number of companies which have cited large tariff expenses in their earnings filings and calls. It is interesting to compare their performance over the last ~6 months (since the supreme court issued certiorari on the matter of the Trump tariffs on 9 September 2025) with the Kalshi prediction market for a ruling against the tariffs. If there is going to be upside from a potential ruling against tariffs, how much of that is already priced in? Another interesting factor that we’ve mentioned before - April 15 tax day as a liquidity drain blackhole. Funds entering the treasury general account leave the banking system and so paying taxes acts as a drain on liquidity, which could explain stock market declines around this time of year. But if the tariffs were to be struck down, and ordered to be refunded, this could well offset some of the liquidity drain. Domain registrars and Public-Private Market Equivalence - 15 Feb 2026

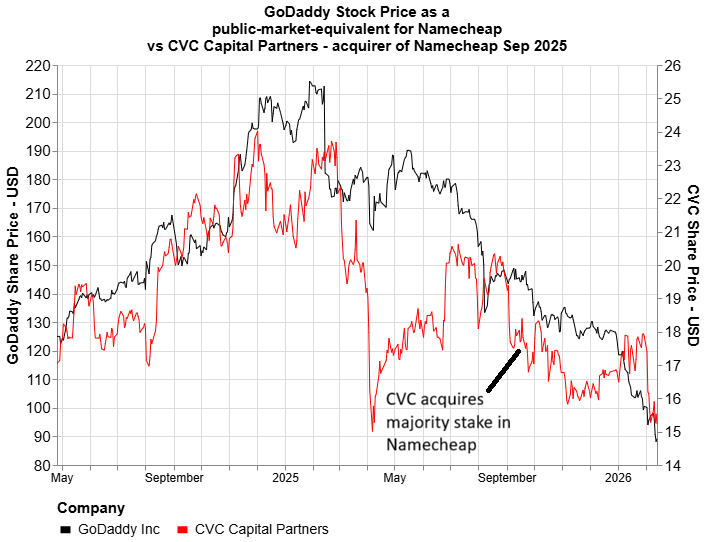

1Stock price data from Yahoo! Finance For a while, it looked like domain name registrars might be a big beneficiary of the vibe-coding phenomenon. At its peak valuation in Jan 2025, GoDaddy had a market capitalization of nearly $30 billion. It’s now down a staggering 55% to $12 billion in a single year, trading around $90 which is not far off the $75-80 range where it has traded for much of the last decade. Given that GoDaddy has a market share of around 30% of the domain market, and the second largest company by market share (Namecheap) was acquired by CVC Capital Partners in September, it seems a bit strange to us that their revenue has not grown more. Speaking of CVC - when this private equity firm acquired a majority stake in Namecheap for $1.5billion in September 2025, GoDaddy had already experienced some of its precipitous decline. However since then, it has fallen nearly 40%. If we were to assume that CVC took a ~50% stake in Namecheap (paying roughly $750 million at the time), and that GoDaddy was a good “public market equivalent” benchmark for Namecheap, and its decline did not reflect a loss in market share to Namecheap (which is a BIG assumption, admittedly), then the current potential drawdown in GoDaddy of 40% would be equivalent to a roughly $300 million loss in value for Namecheap and its owner. The flipside of course is that Namecheap could have made up some or all of the market share loss from GoDaddy, and CVC could be sitting on an unrealised gain. Unfortunately determining that would require quite a bit more analysis. In the meantime, CVC market cap is down about 15% or $2.5 billion since then September 2025, likely another victim of the SaaSpocalypse. This makes us wonder - why is the largest domain registrar not benefitting more from the supposed vibe coding explosion? Or, does it still stand to benefit but it is also suffering, potentially unfairly, from the negative sentiment around SaaS, in which case it might be undervalued? Or has the rush to register domains for future vibe coding projects slowed down? Private Credit and Software There has been a fair bit of coverage of private credit and software in recent weeks. The FT recently highlighted the sheer magnitude of the software exposure that private credit as an asset class has, with particular emphasis on Business Development Companies - typically listed providers of debt and equity to middle market businesses. Of the two largest funds (Blackstone Private Credit Fund and Blue Owl Income Corp), the first had around 30% of its loans to tech, most of which was made up of software companies. A Bloomberg article on Friday found that this might actually be an understatement - at least 250 investments totalling over $9 billion of exposure was made out to companies not classified as software companies, but considered software companies by other lenders. This makes it quite difficult for investors to assess true exposure. Dealmaking in this space also doesn’t seem to be slowing down yet with Bloomberg reporting Goldman leading a $3.5 billion loan for a buyout of Clearwater Analytics that valued the company at $8.4 billion - more than it has ever traded for publicly according to CompaniesMarketCap. A similarly large premium on recent public market valuation was afforded to OneStream in the take-private deal by Hg. It is certainly not evident where all of this leads - whether SaaS will continue to decline, and if so whether there will be knock-on effects or contagion of some sort to those who own or lend to these companies, or whether it will stabilize. Regardless of the terminal destination, we expect significant volatility and possibly a few short-squeezes before we get there. Indeed short interest for IGV stood near its highest ever last week. A potential catalyst for such could simply be clarity from some of the hyperscalers on whether they consider SaaS to be likely to be disrupted by their own technology (which, if the drawdown because of this disruption continues, might start to threaten the broader tech equity market). As we've mentioned before, we've dipped into some SaaS and we're now considering some of the BDCs. It's not immediately clear whether this would be a short-term play, if any. Accounting for irregularities - 12 Feb 2026We saw two interesting news stories the last two days that stood out. Today, ICON Plc, a clinical research organisation, revealed that it had launched an internal investigation into its accounting practices. This related to a potential revenue recognition from 2023-25 and a potential overstatement of revenue in 2023 and 2024 of less than 2%. It also withdrew its guidance for 2025 and would announce it on April 30 this year. Its stock proceeded to drop over 50% at one point today. Earlier this week it was Kyndryl’s turn. The global enterprise technology services provider announced that it was launching an internal review into its accounting practices, following an SEC request for documents around its “cash management practices, related disclosures, internal control over financial reporting, and certain other matters”. Its CFO and general counsel departed the firm as well, although this was announced earlier. It was also delaying its guidance. Its stock dropped around 55%, and dropped again today. “Falling Knife Capital” is probably looking at these stocks but also wondering whether there is more pain to come, or whether the drop is completely overblown. We’re curious whether we see more of these “irregularities” appearing, or whether this is confirmation bias for a view that there is something systemically fishy going on. Some more weakness in “bellwether” stocks1? - 11 Feb 2026

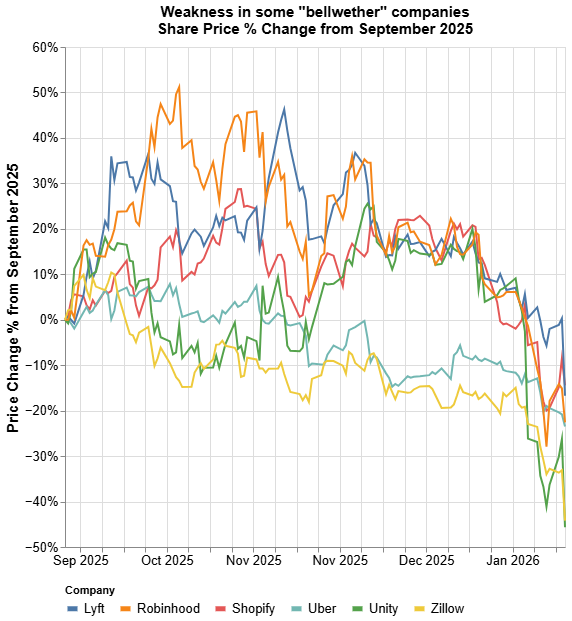

1Stock price data from Yahoo! Finance The US reported January labour data today. As we suspected yesterday, the US administration’s comments leading up to the release were too downbeat and the data surprised to the upside - jobs created came in at 130 000 over much lower consensus expectations, unemployment inched down to 4.3% and earnings grew 3.7%. The market response has been somewhat strange - an initial pop higher for the indices with the Dow Jones Industrial Average retouching its record high of 50500 and the Nasdaq 100 briefly back up to around 25350, before both going lower. Yields spiked along with the US dollar around the release time and market open, so the move in indexes in dollar-terms was even more pronounced. But through the index noise there are a handful of stocks that have had interesting moves today. Some of these stocks reported earnings - Shopify, Lyft, Unity Software, Robinhood, and Zillow. At one point today all of these features on the Yahoo! Daily losers leaderboard but some have since recovered. To us, these stocks have some characteristics of bellwether stocks. Some of their recent decline can be explained - Unity is probably down a bit because of Alphabet’s game AI engine as well as softer guidance, Robinhood has taken a hit because of crypto’s dramatic decline since last October, Shopify has probably taken some of the SAASpocalypse heat. But Shopify initially popped higher before dropping for an intraday max decline of over 20%. We found it interesting that Uber was down with Lyft, even though Uber had had relatively good earnings recently. We’ve lightly dipped back into Robinhood, Shopify and Unity. But we’re very cautious on these names still. Falling Knife Capital to the rescue? We closed our Generac position today for a gain of 40% since early Jan. It's already up another 2% since we sold... What could Corporate Bond Issuances1 mean for interest rate2 expectations?1 - 10 Feb 2026

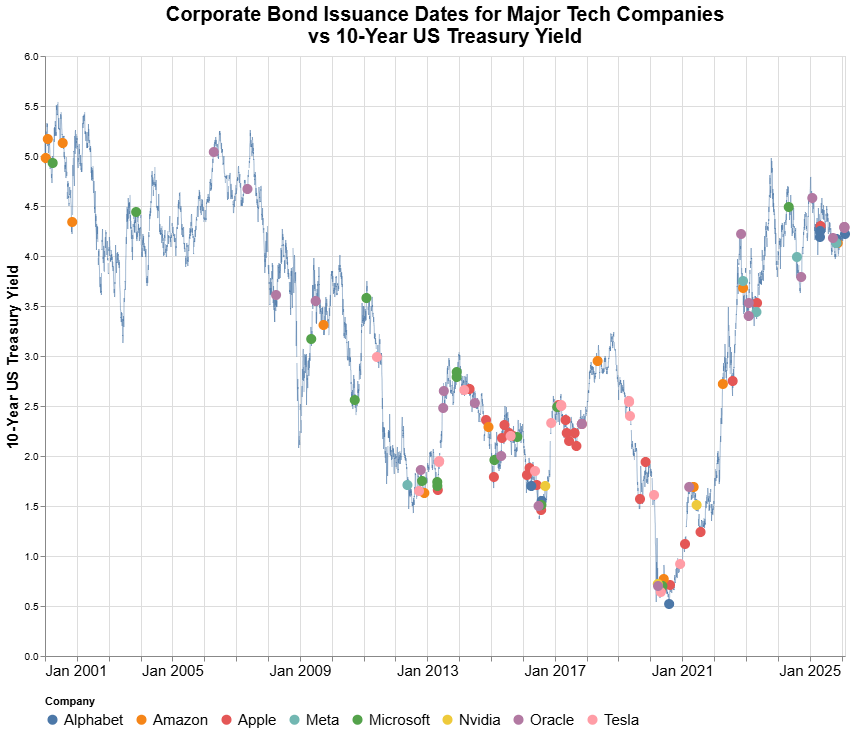

1Bond issuance data from SEC 2Bond yield data from SEC Alphabet’s recent bond issuance has made a lot of waves. They raised over $30 billion over the last few days, and their US dollar denominated offering attracted the strongest orders of any corporate bond issuance ever. Clearly Alphabet is confident in their extraordinary capital expenditure ambitions, and the market’s appetite for it seems boundless. This follows a similarly enormous raising by Oracle in the last week. And indeed over the last year, 5 tech titans (Alphabet, Amazon, Apple, Meta, Oracle) have tapped capital markets. As we’ve covered previously, Apple in 2025 tapped debt markets for the first time in 2 years. We also covered the question of whether the finance gurus who work for these companies have some clairvoyant capacity to guess whether interest rates are going to go up or down over the next few years, and therefore whether any given time was a good time to borrow. Why would a company borrow money?

Practically, these titans can raise funds at interest rates similar to US Treasury bonds and their interest expense is probably a relatively small portion of their total profits. But at the same time, they are raising billions of dollars of capital which means hundreds of millions of dollars in servicing costs every year - every basis point probably matters, especially if you're the CFO. So let’s focus on the last possibility. What are different ways in which it might become harder or more expensive? The main one would be if interest rates went up - either for these companies specifically, or for borrowers more broadly. But interest rates are not low right now. Indeed the 10-year yield is only about 80bps from its 15-year peak reached at the start of 2025. Which means that either these companies are not really sensitive to borrowing costs, or they are sufficiently strapped for cash that they need the financing now, or they expect interest rates to be higher a few months or years from now. Given that these companies are building out AI, potentially racing after Artificial General Intelligence, perhaps the cost of their debt doesn’t matter (or so they believe) because whatever they generate from these borrowings will far exceed the costs. Or, potentially more likely, they simply believe now is a better time to borrow money than in the near future. And if that is the case, we expected US equities, bonds, or the US dollar itself, is not correctly priced. We keep coming back to the US labour report on Wednesday. It seems that everyone is prepared for some dramatic downside. Something just feels off. We think it’s either going to be a bit of goldilocks - maybe decent jobs but with some softness in earnings growth, in which case US rates and dollar could probably resume their gradual recent softening. Or, we suspect, it’s going to be a blowout. Unemployment down, jobs up, maybe even earnings up. Yes, nothing ever happens. But tomorrow it probably will. Political contributions as a trading strategy 2.01 - 9 Feb 2026

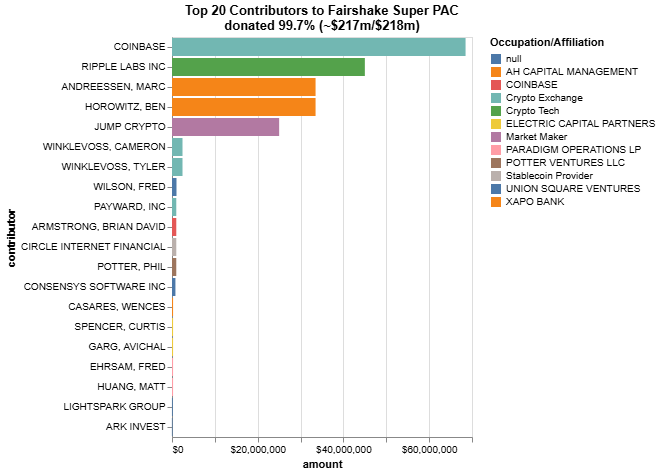

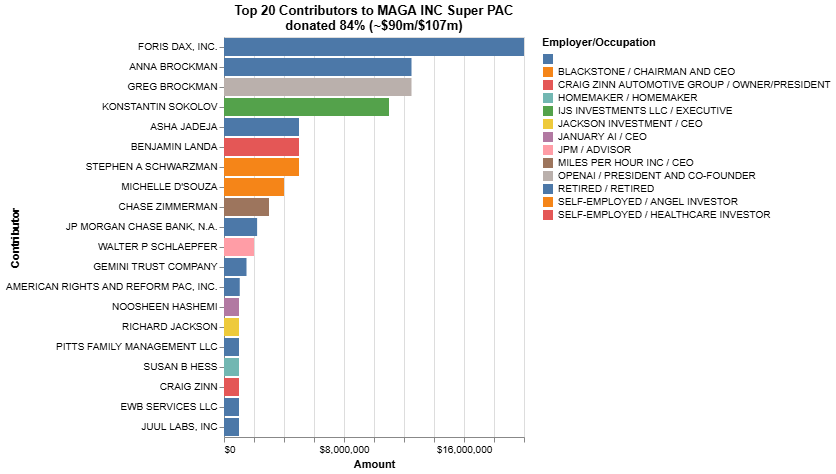

1Fairshake Inc contribution data from OpenSecrets Fairshake super PAC supported pro-cryptocurrency candidates in the 2024 US election and raised over $ 200 million during that cycle, according to data compiled by OpenSecrets. They’re also entering 2026 with a similar amount of money and are sure to support pro-crypto candidates. What we’re wondering is how much of the rally in crypto leading into the 2024 election, and subsequently, was pricing in this pro-crypto support. And whether the coffers can recreate that in a midterm election year. Week ahead There are two big data releases this week that could have significant market impacts - labour data on Wednesday 11th and inflation data on Friday 13th. Director of the National Economic Council Kevin Hassett said they expect lower jobs numbers. Which we feel suggests either the number is going to be really bad, or ironically surprise significantly to the upside - unlikely to be in between. At the moment we feel the market is probably preparing more for a downside surprise. The US dollar has come down a bit since Friday while treasury yields have retraced some of their fall. We’ve mostly been of the view that the dipping near-term inflation expectations, and the resultant spike in near-term real yields, have been because of hints of economic weakness. But what if it’s not? What if real rates are spiking because the economy is going to take off from here? There are admittedly a few near-term potential asset price shocks - one of the main ones being the liquidity black hole that is April 15 tax day in the US. But what if the data is better than expected, and the Trump administration manages to thread the needle just right - with ceasefire or peace deals with Russia and Iran, a meeting between Trump and Xi potentially as soon as the first week of April… A lot of ifs, admittedly, but if we can see a path higher for equity markets from here, they certainly can. We are not as positioned for the upside, for if the pain trade is higher, than we'd like to be... Political contributions as a trading strategy1 - 8 Feb 2026

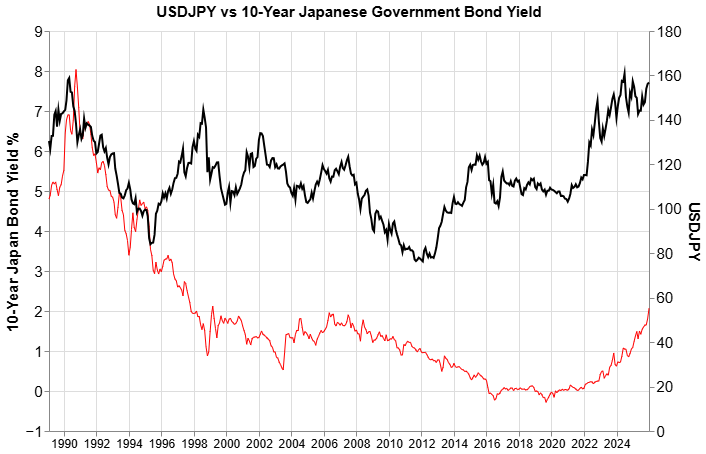

1MAGA Inc contribution data from Federal Election Commission Do more successful people and organisations donate more to political action committees (PACs), or does donating more make them more successful? It would be interesting to plot the fortunes, on an absolute and relative basis, of the significantly contributing organisations and people. We note that the largest single contribution came from FORIS DAX INC the parent company of the Crypto.com exchange. Fairshake, a crypto-focused PAC, raised several hundred million dollars during President Trump’s previous election cycle. The largest joint contribution, if taken together, came from OpenAI CEO President and Co-Founder Greg Brockman and his wife Anna Brockman. In the healthcare space, Nosheen Hashemi of January AI donated $ 1m as did Benjamin Landa of Sentosa Care. It could be useful to construct a hypothetical portfolio with exposure to these people and organisations and to backtest its performance. However this may prove difficult as many of the organisations are private. Perhaps listed analogues can be found. USDJPY Japanese PM Sanae Takaichi won a landslide victory in the election over the weekend. The Nikkei 225 was at one point up 3.5% in overnight trading and USDJPY was down as well, indicating that markets liked this result. But we wonder how much of this was a continuation of the rally (short squeeze?) that took place in other markets on Friday. The question now is what does her strong parliamentary support mean for previously declared plans to dramatically increase military spending, as well as her hawkish tone with China? Will the BoJ tolerate higher JGB yields or a much weaker Yen? Or will they somehow manage to get it all - a Yen that trades with reasonable stability between 154 and 160, JGB yields coming down a bit, the equity market holding steady, and inflation at target while the sky-high consumer inflation expectations come down? Seems like a very difficult needle to thread for the BoJ. So no, we think not. One of those things is going to break, and we have a feeling it will be the USDJPY going above 160 in the not too distant future. QQQ ETF Intraday Volatility Higher on Mondays1 - 7 Feb 2026

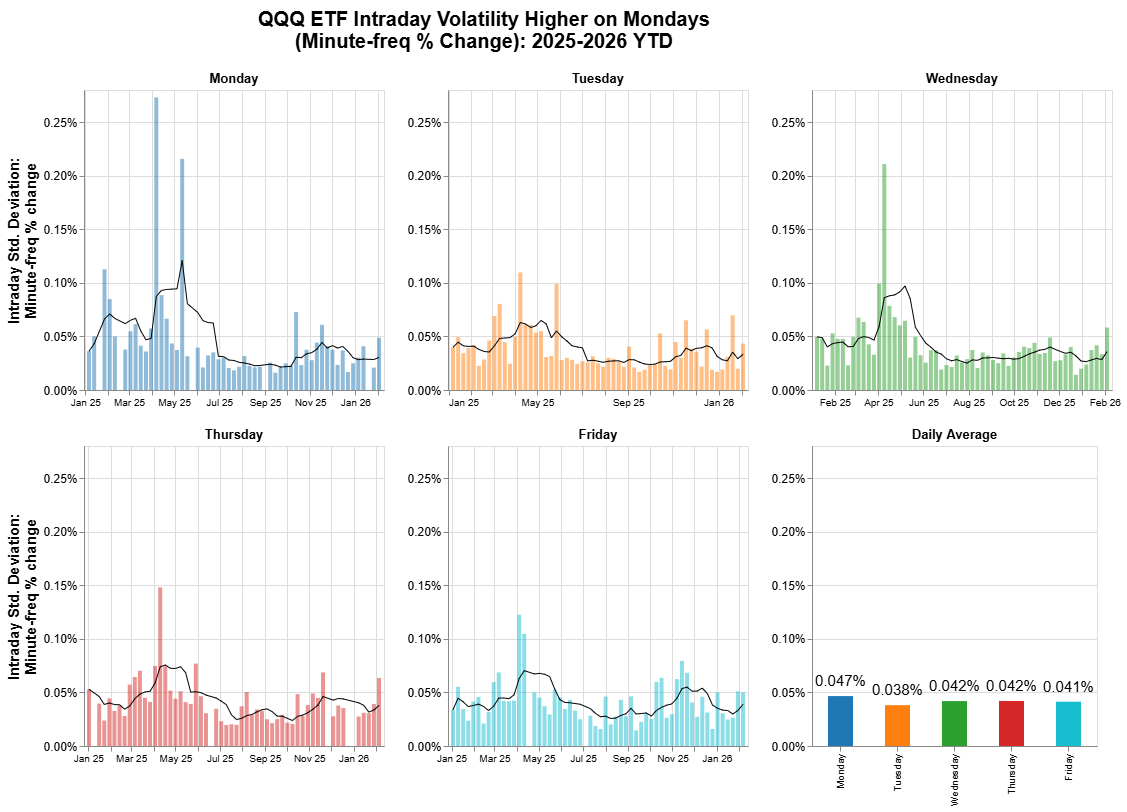

1ETF Intraday Data from Massive Intraday equity volatility seems to vary across the trading week, with Fridays and Tuesdays slightly lower than other days, and Mondays showing the highest volatility, as calculated by taking the standard deviation of minute-frequency percentage price changes for the entire day. This was the result we found looking at price changes for the Invesco QQQ ETF. This supports the anecdote that the VIX (although it is based on the S&P500) tends to drop going into the weekend and spike at the start of a new week. This should not be taken to mean that equities will dip on Monday or that volatility will necessarily increase. We are increasingly of the view that other factors like positioning should also be taken into account when prognosticating about near-term equity market developments. But there is a lot happening over the next few days to which the market may react violently, including the Japanese elections on Sunday and Non-farm Payrolls on the 11th. Leveraged and Crypto ETFs1,2 Dominated Trading Volumes Today - 6 Feb 2026

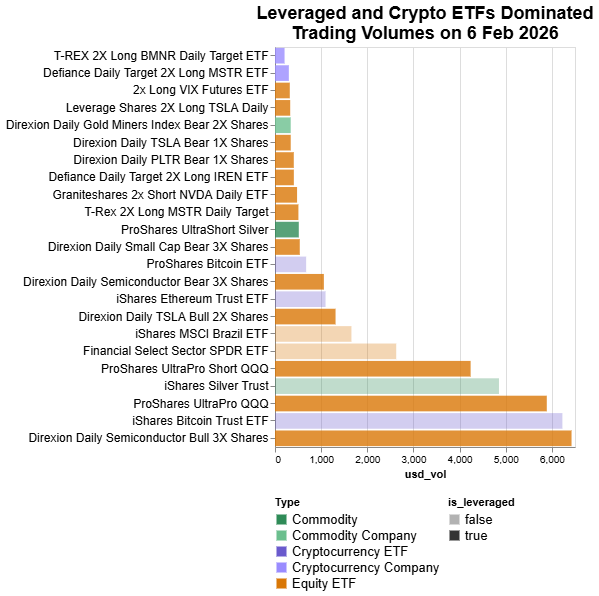

1ETF Volume Data from Yahoo! Finance ETFs 2List excludes QQQ and SPY ETFs On Friday investors piled into semiconductor and cryptocurrency stocks including via ETFs and leveraged funds and products. Intraday volatility in the underlying securities of these instruments are surging and are being magnified to extreme levels through leverage. Perhaps this is more evidence that we are entering a more dramatic volatility regime than we have seen in recent months. Truflation's Real Yields Reach Highest Since April 2025 - 5 Feb 2026

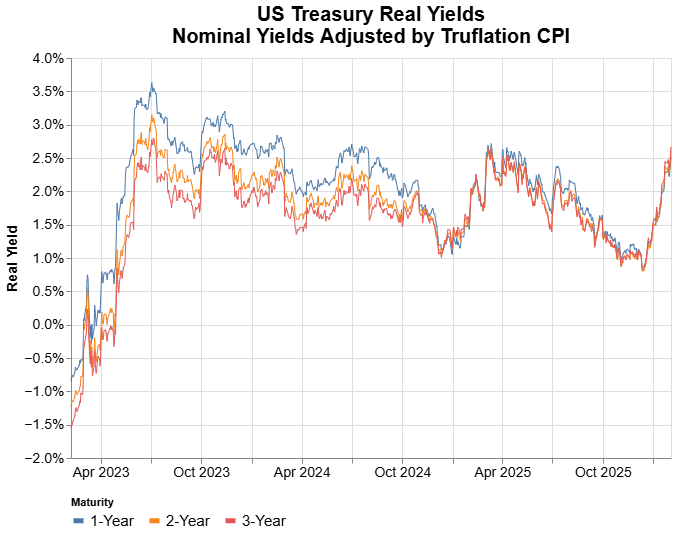

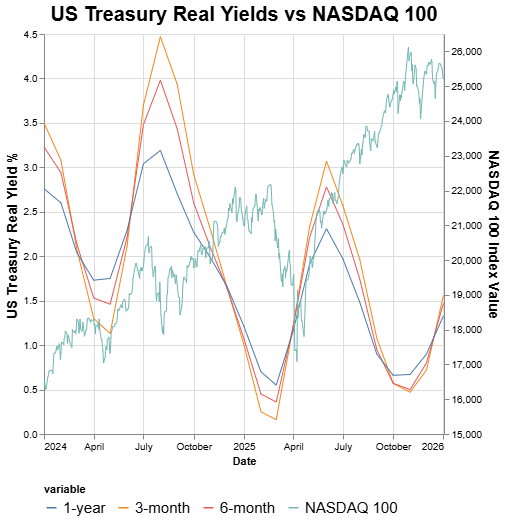

1Truflation data from Truflation Official US CPI data suggests that the US inflation rate is around 2.7% per year. Truflation data suggests otherwise and using US treasuries to calculate real yields for relatively short tenors (1-3 years) shows that real yields have increased to their highest levels since April 2025. In our view, real yields imply two things - monetary or lending conditions are tightening and/or there is an expectation of economic expansion. One of those things tends to be good for asset prices, and the other sometimes happens before market crashes. Is the current environment more similar to the US economy in early 2023, where rising real yields preceded booming economic growth, or to the US economy in early 2025, where a slowdown was occurring, economic uncertainty spiked and financial conditions tightened considerably? We leave this for the reader to decide. Is Crypto Too Big to Fail? - 4 Feb 2026

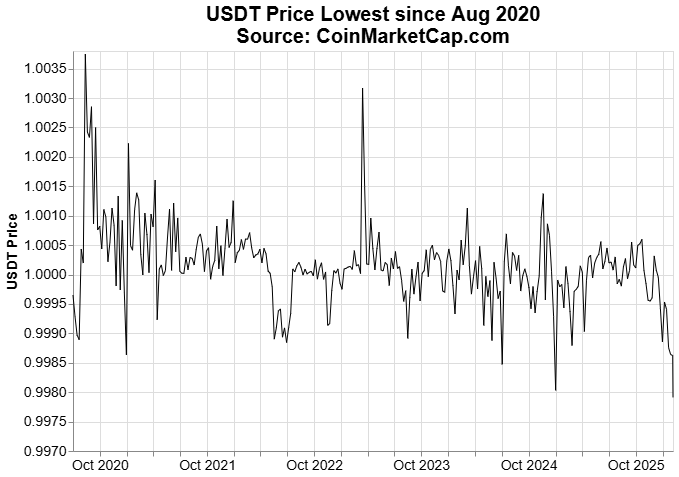

1Tether price data from CoinMarketCap According to BitcoinTreasuries, the top 100 public companies hold 1.13 million bitcoin. At the current price of around $73 000 that is equivalent to around $82.5 billion. With another roughly 2.95 million held by other entities like private companies and governments, they estimate the total bitcoin held this way to currently be worth around $300 billion. At the market top in October when it was worth closer to $123 000 per bitcoin, assuming the same amount of bitcoin was held, this stash would have been worth nearly $500 billion. A loss of $200 billion sounds like a lot but Microsoft alone since its peak in October 2025, having lost 25% of market cap since then, shed $1 trillion - nearly 5 times that. Of course this excludes other cryptocurrencies but bitcoin comprises the majority. There are two reasons why this might underestimate the broader impact. Firstly, many of these companies have raised debt to purchase bitcoin, or may hold other securities as in their overall portfolio. If the price of their bitcoin drops enough, they may be forced to either sell bitcoin or its other assets in a forced deleveraging or reduction in exposure, potentially deepening a selloff in securities markets more broadly. And depending on the capital mix, the overall size of bitcoin holdings, and other factors, the decline of the company’s value (private or public) may be as large as or even larger than the decline in bitcoin. Secondly, as cryptocurrency value more broadly declines, the demand for stablecoins like USDT or USDC may decline as well, and they may face redemptions. These redemptions would likely require selling off the assets held as collateral to maintain the 1:1 peg that these two stablecoins have with the US dollar, potentially also furthering a selloff. Given that stablecoin providers are collectively one of the largest holders of short-term US Treasury debt, and they may choose to sell off these “safest” of assets first (especially if the remainder of their portfolio were in a drawdown/showing an unrealised loss), which would put upward pressure on short-term interest rates (and potentially longer term ones as well). Indeed one can see a hint of this already - USDT is currently showing the largest deviation from its $1 peg since the Covid-19 market turmoil in March 2020, already exceeding the April 2025 drawdown. Granted, the deviation is tiny. But relative to recent history, it is significant. We see two paths forward. The first assumes we are at, or close to, a bottom in large cap equities, indices and other assets like cryptocurrency. Perhaps selling is exhausted and the reversion to previous trajectories and apparent “discount” to peak 2025 levels is too alluring, especially for crypto. We believe this requires a significant positive catalyst. We don’t see this coming from the driver of the previous equity market top (AI and AI infrastructure). Nvidia earnings are too far away - maybe Alphabet turns higher overnight and maybe Amazon blows the roof off tomorrow evening. More likely, we think, is a significantly positive legislative victory for crypto. This would have to come soon, however, as further delay might push the passing of legislation into the next congress. Positive catalysts unrelated to crypto could be a potential ceasefire involving Russia or Iran, a supreme court ruling on tariffs (although its market impact remains unclear), another tariff deal or climbdown. With the SAAS drawdown, private credit BDCs facing pressure, and some major leveraged ETFs like the SOXL down to the October-December 2025 peak, it is likely that large short positions remain accumulated in some names. It is easy to imagine a trigger that could cause significant short-covering and take us up from here. In the absence of a significant positive catalyst, we likely find ourselves on the second road which is far less ebullient and will be characterised by further deleveraging. Not just in the conventional sense of reducing debt exposure, but perhaps even less availability of leverage in the first place. A large provider of Stocks & Shares ISA accounts today informed clients that they would, before the end of February, stop offering trading of leveraged funds and any short ETFs. We were quick to be reminded of the seemingly insatiable betting on commodity price volatility by this headline today - highlighting that the Wisdomtree Oil ETF saw inflows of $200 million today, the largest since the pandemic. After the experience this past week of two restrike events in the same leveraged ETP provider, and the extraordinary volatility which may arise from US actions in Iran (peaceful or otherwise), we are reminded of an adage that the market will go wherever it wants to, but will ensure that you are not onboard. Unless there’s some major good news on the horizon that we’re missing, we are beginning to suspect that leverage itself might be the next victim of this market. Public vs Private Markets - PayPal, Block, Stripe1 - 3 February 2026

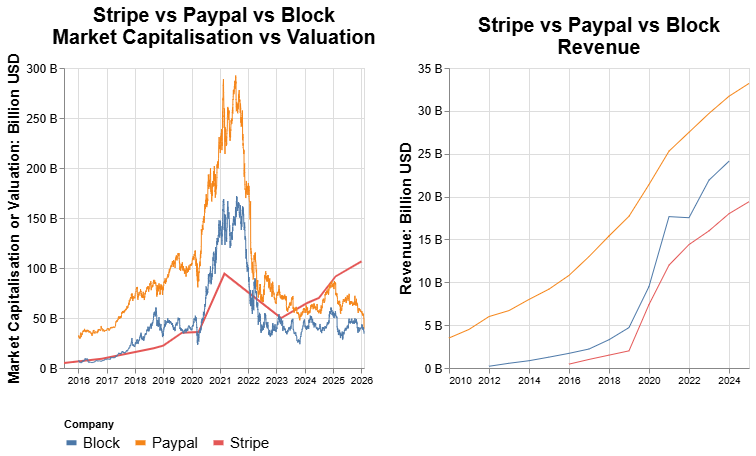

1Stock data from Yahoo! Finance Disclaimer:We own a small PayPal position as of today. PayPal reported earnings today and shed 20% or nearly $10 billion in market capitalisation. Payment processor competition Block and Adyen were down 6% and 7% respectively. Interestingly, this move today puts the market capitalisation of those three companies at $39bln, $36bln and $43.5bln respectively. The three listed companies processed similar total payments volumes in 2024, and PayPal’s release showed they processed $1.8 trillion in payments. Looking at revenues, PayPal exceeds Stripe by about $13 billion or 65%, and Block by roughly $10 billion or 40%. And yet at the moment PayPal and Block have roughly the same market capitalisation. And Stripe’s most recent funding round valued it at $106 billion. Stripe does many things right and many things in addition to being a payments processor. And event this is only a revenue and TPV comparison - it says nothing about profits and free cash flow. Some think comparing these three companies are comparing apples and oranges - two mature, low margin dinosaurs against a private payments innovation machine. But is Stripe really worth over 2.5x as much as PayPal or Block? Could it be that this market-cap-valuation gap will close, and if so, from which direction will it close? On another somewhat sombre note - even though PayPal’s revenue and TPV grew, its share price still dropped enormously amid weaker than expected earnings. Could it be that these online payments processors might be picking up broader economic weakness before it is apparent elsewhere, similar to our earlier views on SAAS? We are increasingly of the view that the total addressable market may either turn out to be smaller for many of these companies (SAAS, payments, entertainment) than investors expected, and that they will ultimately be competing with more market participants than expected for that fixed piece of pie - human attention, not spending power. Sources On commodity volatility - 2 February 2026

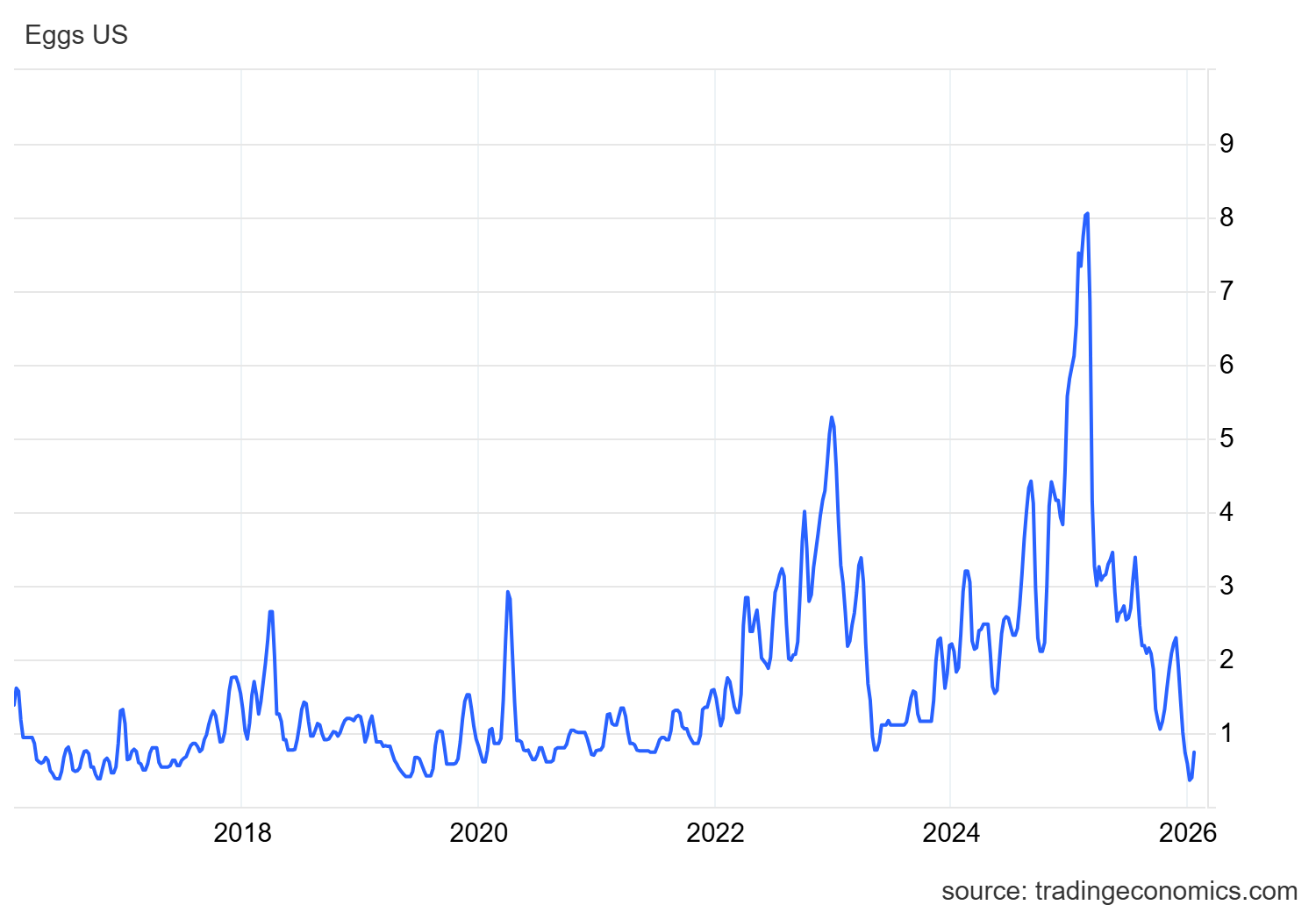

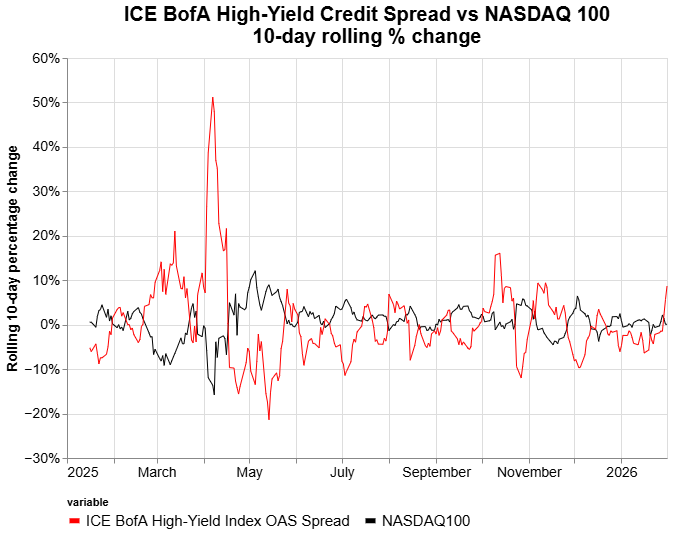

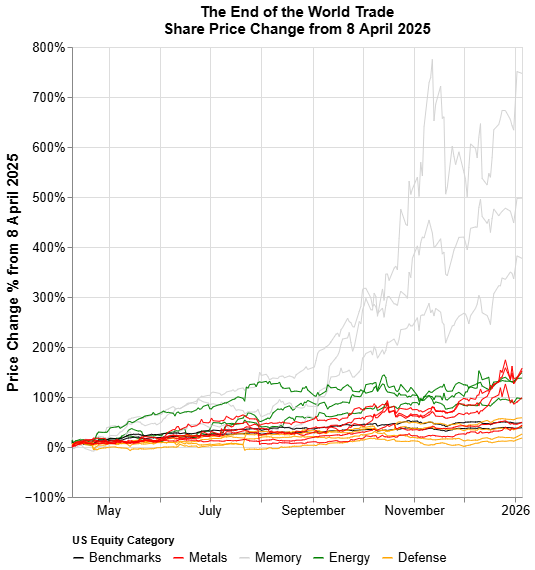

1Source:ICE BofA via St Louis Fred Natural Gas Natural gas had its largest 1-day drop in 30 years, on easing of tensions between the US and Iran, and warmer weather forecast in February. And as we predicted over the weekend, a provider of leveraged natural gas funds experienced a restrike event. When was the last time the same ETP provider had a restrike event on consecutive trading days for different underlying commodities? We’ll be keeping a diary of those. An exploding commodity price volatility regime is only good for market makers and commodity traders, and certainly not for end users or buyers trying to plan for the year ahead. Options prices spike during volatile periods and so those trying to hedge themselves will spend a fortune on premiums. Eggs We recently talked about egg prices in the US likely hitting a bottom, and on that basis looked into Vital Farms and Cal-Maine Foods. Well either there’s a glitch on the website or eggs in the US just dropped 95% to $0.06 per dozen. Most recent USDA data is still pointing at $1.05 and perhaps it has to do with the US government shutdown. Otherwise, something fishy is going on with eggs. Credit Spreads Finally, we saw that the ICE BofA High Yield Option Adjusted Credit Spread spiked again last week. In the past significant spikes have been accompanied with market volatility. The 10-day change is the highest since November when the NASDAQ 100 saw a slight correction. But this spike could have been Friday’s metals panic and might not have broader market implications. The rest of this week might give us a clearer signal but on the whole we’re positioned for some downside here. Geopoliticking - 1 February 2026Disclaimer: We have previously owned, or currently own, positions in silver and natural gas ETPs, long and short. Extreme caution is advised in using these instruments. Natural gas futures opened -15% at 11pm GMT. For those watching, we’re 5% away from a restrike event in some of the leveraged natural gas exchange traded products, like the silver ones experienced on Friday. And indeed silver was down to $77 shortly after market open. It was trading at around $94 on Friday when the silver restrike event happened. And the 20% restrike for the 3x leveraged funds is around $75. If we’re even a little bit out with the margins, it could be that they had another restrike this evening. Over the weekend there was some news coverage about a US “armada” heading to Iran and of good meetings with a Russian delegation. Russia and Iran are the world’s largest natural gas producers behind the US, and major oil producers. We see a near-term catastrophic downside headline risk for natural gas and oil prices on those two fronts over the next couple of weeks - potential peace/ceasefire deals with Russia and Iran. This would likely be very negative for energy prices, positive for equity markets overall, and negative for a handful of recent darling sectors - defense, rare earths, and precious metals. This latter effect would be channeled through a reduction in tensions between the US and China, as Iran supplies a significant amount of China’s oil imports. This could potentially be negative for US and South Korean memory stocks as well, if part of what has been driving them recently has been stockpiling in case of trade disruptions. On the topic of a strike on Iran and whether it would happen, there are a few factors to consider Iran President Trump is already facing pressure because of recent tensions with Greenland and NATO, as well as the ICE killings in the US. Equity market performance has stalled since October and looks vulnerable to the downside. The midterms are fast approaching. Could the US strike Iran, perhaps a highly targeted attack on the Ayatollah, without getting involved in another war? Also the last time the US struck Iran through attacks on its nuclear enrichment facilities, there was not this much advanced warning. The “gigantic armada” seems a lot more like a threat that is designed to be responded to with submission, not aggression. A senior adviser to Iran’s supreme leader, Ali Shamkani, indicated that “...any military action by the United States…will be considered the start of a war…” and that the “heart of Tel Aviv will be targeted”. President Trump specifically noted “no nuclear weapons” in recent social media posts but key US demands remain 1) no nuclear weapons or even enrichment program, 2) reduced number and range of ballistic missiles, and 3) not supporting resistance groups in the area. A deal including reduced sanctions on Iran could see Iranian natural gas and oil exported more widely, which would likely weigh on natural gas prices. This feels like a difficult needle to thread. We are inclined to err on the side of "Trump likes to make a deal". Escalation with Iran, with no recent mention of provocation (unless the alleged deaths of thousands of protestors resurfaces as motivation), doesn't seem desirable. Another caveat to this is that the US is currently the largest natural gas exporter in the world and so, perhaps, it could benefit from a year of elevated natural gas prices. We remain positioned for significant moves in both directions. Russia Kirill Dmitriev, the Kremlin's special envoy and head of Russia’s sovereign wealth fund, met with Steve Witkoff and had “constructive” talks over the weekend. Next stages of the negotiations will likely focus on the 20-point peace plan. Key outstanding issues are what would happen to Ukrainian-controlled territory in Eastern Donetsk and security guarantees against potential future Russian attacks. As Donetsk was one of the first places seized by Russian forces during the 2014 “Russian Spring”, control over this region remains a particular sticking point. Similarly to Iran, a more credible Russian ceasefire would likely lead to significant downside pressure on oil and natural gas prices. Cuba The final bit of geopolitics we’re looking at concerns Cuba. As Venezuela was previously supplying over a third of Havana’s oil, and the US is reportedly considering a naval blockade, pressure is mounting on the Cuban regime. It is worth noting that beyond its undoubted strategic value to the US (much like Greenland) Cuba has the ,world’s 4th largest cobalt reserves and is a top-10 producer of nickel, materials crucial for batteries and other electronics, among other uses. This seems like a geopolitics piece but it’s really more about leverage in the end. We were concerned about a sharp natural gas drop on Friday and took appropriate action to hedge against that. As ever, with a 15% gap move at futures open, we wish we’d taken far more action. This week has served as a crucial reminder of the dangers of excessive leverage, especially within the commodities trading space. It’s quite likely that there may be some rippling effects of the silver drawdown on Friday felt across markets this week. We reiterate our view that this could encourage a move towards private markets, where volatility appears lower. And, conversely, also towards higher-frequency, higher volatility markets. Open interest in the USDC-SILV on Hyperliquid exploded this weekend and could be traded by those too impatient to wait for futures to open Sunday evening. Prognostications - 31 January 2026In celebration of reaching the end of January in one piece, we decided to make a few bold predictions. The tone is perhaps more on the cautious side and so perhaps it appropriate to start with a somewhat more upbeat statement of a view: Abundance may well be within reach in our lifetimes. This has probably never been truer before than it is today. And as a result it is this generation’s fundamental responsibility, to the past, present, and future, to do everything in our power to facilitate that. This view of the future is based on the following assumptions:

In concert, these factors promise to uplift entire swathes of the global population within the next few decades, perhaps most especially on African continent where these factors will contribute to a large, young population joining a more integrated global workforce and participating more actively in its economy. Many significant roadblocks may prevent this deeply optimistic vision of the future from realising. But none of those, we believe, are insurmountable. Now that we have expressed this view we can return to the more Cassandra-like worries that keep us up at night, as it appears we may be on the brink of squandering this historic opportunity. These ideas are expressed simply here and in the coming days and weeks will be expanded upon in more detail.

Silver: A Controlled Demolition - and where to next? - 30 January 2026Disclaimer: We have previously owned, or currently own, positions in silver and natural gas ETPs, long and short. Extreme caution is advised in using these instruments. At one point today the price of gold and silver were down 11% and 35% respectively. They ended the day down around 9% and 27% lower. Given that gold had an estimated “market capitalisation” of around $37 trillion before today's fall, and silver around $5.6 trillion, one could say that today saw nearly $5 trillion in wealth destroyed. This is roughly equivalent to the NASDAQ 100 dropping 10%, and which would be the largest single day drop in market cap ever. It was also fascinating to see it occur while much of the rest of the equity market (excluding resource and mining companies, of course) remained largely undisturbed, and for the VIX to remain relatively subdued. Compare this to the 25% decline in the overall crypto market from its recent peak in October 2025, which in our view had a more pronounced negative effect on the rest of the market (although other factors were involved). Similar to the crypto crash, retail traders were significant participants in the recent silver rally and therefore likely suffered during today’s collapse. Retail represents nearly 20% of the average daily trading volume in US equities. Given the speed at which the precious metal rally happened over the last couple of months, one might argue that the price of silver and gold might not have been reflective of their “true” value in recent weeks. But then - what was the true value? And what does that say about the price of other “assets”, particularly those that are supposed to be a “store of value”? And does it mean that, at certain prices, some assets stop being a store of value? Does the estimation of the value of a certain amount of an asset, like shares of stock or ounces of gold, take into account the price impact of trying to sell that asset? Restrike event - 3x leveraged long silver ETPs Something else happened today that will no doubt come as a very nasty surprise on Monday to some of the less sophisticated traders of leveraged exchange traded products. The 3x leveraged long Silver ETPs run by Wisdomtree experienced a “restrike event”. On the positive side, this saved the product and therefore its holders from suffering a -100% loss of their capital, given that at one point silver was down more than 35% which magnified at 3x leverage would have led to -105% capital destruction. On the negative side, the restrike occurred at a price of $500 at 16:51 to 17:06, after which the underlying dropped another ~10% before closing, which would have led to a further 30% loss of capital calculated from the new restrike price of $500. The surprise may come when, if silver rallies dramatically on Monday, investors who bought the fund on Friday just before closing, find that the capital with which they hoped to be participating in the rally, is far reduced. Apropos of nothing, to add insult to injury, it would be deeply ironic if silver rallied on Monday. Tangentially, in the world of prediction markets, it is not hard to imagine that there may emerge a market for betting on whether certain funds experience restrike events. And this would obviously create problematic incentives for market manipulation whereby rogue traders "hunt" down assets that might be susceptible to large price drops (or spikes). More susceptible markets would likely be commodities (as silver has shown) or those that are more illiquid and could see discontinuous price jumps during thin trading. We have a feeling that we have not seen the last restrike event of the year, and possibly not even the last restrike event for silver leveraged products. And given that leveraged ETPs are a popular product amongst retail traders, they should exercise particular caution with these products. Natural Gas Natural gas has recently spiked significantly, with a 3x leveraged natural gas ETP up over 150% in less than two weeks. If a significant event occurs (large natural gas find or perhaps a deal between the US and Iran, one of the largest natural gas producers in the world, is reached) that increases expectations of future gas production or supply, we could see a significant drop in natural gas prices occurring which triggers another such event. We think natural gas prices are currently pricing in a high probability of conflict with Iran. We suspect leveraged natural gas funds may experience significant volatility this week. If these events increase in frequency, this could have a negative impact on the appeal of and demand for leveraged trading products in general. Where to now? To the mountains and valleys of volatility If precious metals were supposed to be a hedge against inflation or equity market downturns, what are the potential consequences for such a dramatic one-day selloff? We could imagine this having two somewhat contradictory impacts on risk tolerance: for some, this will drive them away from leveraged products and other highly volatile securities, traditionally into bonds but those have been volatile as well. For others, experiencing this sort of volatility in what was supposed to be a “safe haven” asset may raise their risk appetite and tolerance for other far riskier assets. Given that the cryptocurrency market overall is still in a significant drawdown from its October high, not to mention that President Trump’s Federal Reserve pick seems to be a proponent of crypto, we could imagine flows returning to cryptocurrencies and associated funds and products. The chatter on social media that crypto folks were behind some of the silver rally in the first place, fuels this speculation. Another alternative destination for the volatility-stricken may very well be a more illiquid asset class - private markets. And with private assets booming in size, there will be plenty of opportunities. If one does not want to see the regular volatility of daily markets, the appeal of private markets is obvious. However the great Cliff Asness has much to say about the dangers of "volatility laundering". With bond returns being particularly poor in an inflationary environment, and now safe haven assets coming under fire, where do you safely park your money? Soft commodities? Equities? Crypto? Question for the future

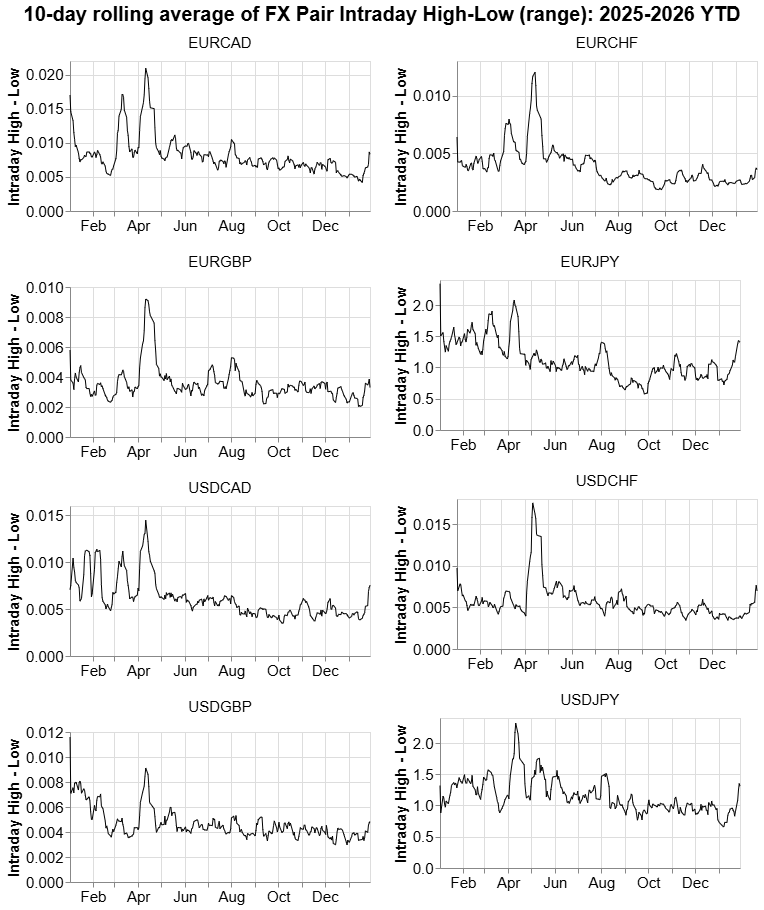

The Return of FX1 Volatility - 29 January 2026

1Stock data from Yahoo! Finance Around 15:00 GMT the DXY US dollar index was around 95.88 when it started to appreciate sharply. By 15:30 it was trading at the high of the day at 96.40, up barely 0.5%. But other assets reacted violently over this same time window, potentially because of this move. Silver fell nearly 11% from 120 to 107 over this same time frame, and gold nearly 7% from 5500 to 5100. There were a few pieces of economic data that came out around then that might have explained it. US factory orders were higher than expected, growing 2.7% instead of a forecast 1.6%, potentially signalling a more robust economy. We’re inclined to say that the cause of the US dollar move was less important than the effect - we believe that move rattled the precious metals trade. And given that gold and silver collectively comprise $44 trillion in "market cap" at the moment, one should not underestimate the extraordinary asset price deflation that a surge in the US dollar could cause. Even if a directional surge is not the base-case here, we are increasingly confident of a pickup in currency volatility more broadly. Several US and EUR currency pairs have started to show some increased volatility over the last few days, with the 10-day rolling average of intraday high-minus-low for some of these pairs hitting the highest since the April tariff turmoil. Rhetoric around foreign currencies has picked up significantly in the last week. This includes President Trump and Treasury Secretary Bessent’s comments about the dollar recently, comments around the South Korean won being too weak and the Chinese yuan being too weak. The semi-annual US currency report was released today as well and while it did not name any specific currency manipulators, the report did state that the US treasury would strengthen its monitoring criteria of other countries. Giving a strong directional view on the US dollar remains difficult at the moment - keeping it low or lowering it further seem to have significant benefits for the Trump administration at the moment. And even today its brief spike higher resolved back down to the 4-year low just below 96. But with the new Federal Reserve Chair in play, increased US currency rhetoric, Japan’s fiscal and monetary policy, and worries about currency debasement coming up, we expect to see this recent surge in currency volatility to continue. And currency volatility has plenty of downstream effects, few of them good. Updates We noted yesterday that one of the most liquid leveraged semiconductor ETFs (SOXL) was approaching a level that it had failed to exceed at previous market tops (around 70). Today at the low it was down -10% to 63. Maybe there was a bit of superstition in the markets. Maybe it's still there. Some Chart Superstition in Tech Stocks1 - 28 Jan 2026

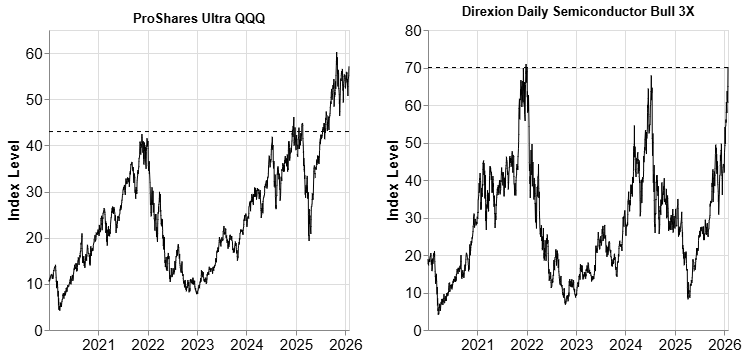

1Stock data from Yahoo! Finance These are two of the most liquid and most highly traded ETFs - the ProShares Ultra QQQ (TQQQ - a 3x leveraged long Nasdaq 100 fund) and the Direction Daily Semiconductor Bull 3X (SOXL). Sophisticated speculators and retail traders alike favour leveraged ETFs because of their liquidity and because they provide opportunity for magnified gain (and losses) and so require less capital to trade for a certain exposure. The gain for TQQQ from 20 to 60 represents a 200% gain over a period of around 6 months. The SOXL gain was closer to 600% over the same period. These are obscene numbers for a 6-month return and we could imagine lucky owners being desperate to cash in on these gains. If you were a US investor looking to realise your gains - would it be worth risking the market turning, in order to be able to wait long enough so that your realised gains would be taxed as capital gain rather than income or would it be better to simply sell off and take the tax hit? Usually we don’t pay much heed to technicals or levels. But with the prevailing conditions, there might just be enough caution in the market for superstition and so it might be worth exercising particular caution when considering semiconductor stocks at these levels. A Commodities1 Supercycle…in this economy? - 27 Jan 2026

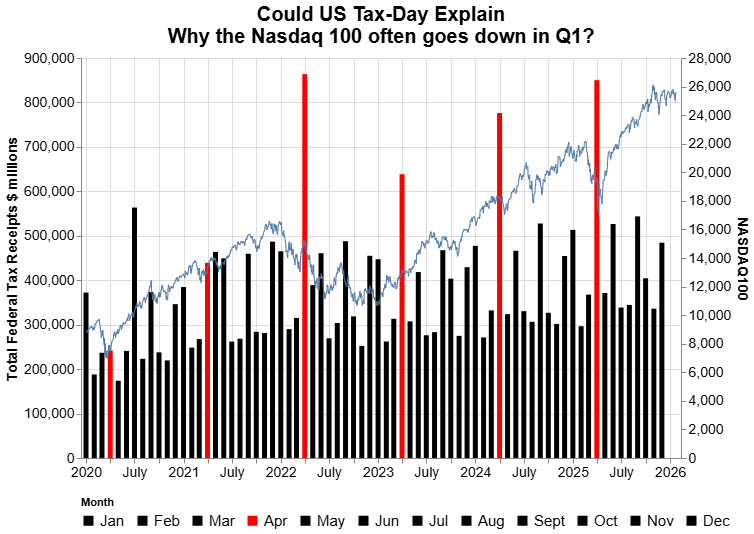

1Tin price data from Trading Economics A handful of cherry-picked articles highlight the difficulty of predicting a commodities supercycle. We do not mean to disparage the brave souls who dared publicly claim a commodities supercycle was at hand, at or near the top of the previous spike in commodities prices. But perhaps there is a certain kind of hubris in declaring that the input costs to much of the world economy is about to soar to new long-term or even permanent highs1234. Niels Bohr is thought to have said “prediction is hard, especially about the future”. Entirely tangentially there’s a great quip about Niels Bohr here from a book by George Gamow. We’ve all been in the position where a confident prediction went spectacularly wrong. We’ve also been in a position where being early on a narrative or trend is the same as being wrong. Or sold too early. But in order to make money in markets you need to be able to at times sit back and see others make a fortune on something you passed on, or dismissed. This sounds like the pontification of someone who was/is out of the silver rally. No comment. So commodity supercycles. This phrase has been floating around on our radar a bit more in the last few weeks. Precious metals’ historic rally has been something to behold. And something to get fired for if you missed out on, or bet against, in a trading position. With the US dollar dropping purposefully below a 4-year low today, a day after we (seemingly prematurely) claimed that rumours of the death of the dollar were premature, the threat of further dollar devaluation and support for the next leg higher in everything denominated in US dollars (i.e. nearly everything), looms large… Federal Reserve Chair Powell slides into view for a rather important meeting of the FOMC, during a storm that has closed federal government offices in Washington DC. Markets expect them to hold rates steady. They’re between a rock and a hard place. At what point does further US dollar decline start to become an imported inflation risk? If they cut interest rates, do they risk spurring inflation? If they hold steady, and inflation has continued to decline in the background, are they effectively pushing up real rates which could hurt bonds and other asset prices. We don’t think the Fed would tolerate much higher yields, or a much weaker dollar. The unexpected move tomorrow would be a cut, or an increase in the treasury buying the Fed has already been engaging in since mid-December 2025. This would put further pressure on the US dollar and probably provide enough impetus to see the Nasdaq back through to all-time highs and beyond. Because it means real interest rates are coming down. It also, incidentally, would play into Steve Donze of Pictet Asset Management Japan’s rhyming US dollar chart which is keeping us up at night, and making us wonder whether there are still a few rungs lower to go for the USD. That might just be enough to keep this “commodities supercycle” that we’ve been hearing about going, or off the ground. The only other thing to do so, in our view, would be that state actors have been acquiring essential raw materials because they are preparing for war or other catastrophic supply chain disruption. And if that is the case, then this commodities supercycle is indeed just getting started. Short of that, however, we think we are at or close to the turning point in the USD and therefore in everything priced in USD. Expensive commodities are very bad for inflation and for politicians unless there’s a war or a pandemic to blame it on. The Death of the Dollar12 (has been greatly exaggerated) - 26 Jan 20261Stock data from Yahoo! Finance 2Federal Receipts Data from St Louis Fred Every now and then a chart does the rounds on social media highlighting the decline of US dollars as a percentage of foreign exchange reserves. There is something compellingly monotonic about the decline in that chart, granted. The US dollar index is down nearly 10% from the start of 2025. The yen recently strengthened dramatically against the USD. Precious metals have exploded upwards in price in the last year. President Trump’s recent rhetoric on tariffs and Greenland and threats of another US government shutdown have all weighed on the dollar. But in addition to the contrarian notion that when social media starts to say “the dollar is dead” (or some such) it usually means the opposite, the world (and specifically all US taxpayers in it) is about to be reminded that there is something very important one can only do with the US dollar - and that is pay US taxes. Tax day, April 15, is fast approaching. And given that 2025 was another stellar year for US equities (even though it underperformed other markets), following two other stellar years, we expect the amount of tax receipts flowing into the Treasury General Account (TGA) to be extraordinary. The barchart below shows how dramatically Total Federal Receipts spike in April in particular, but also in some other months (typically quarter-end like June, September, December).

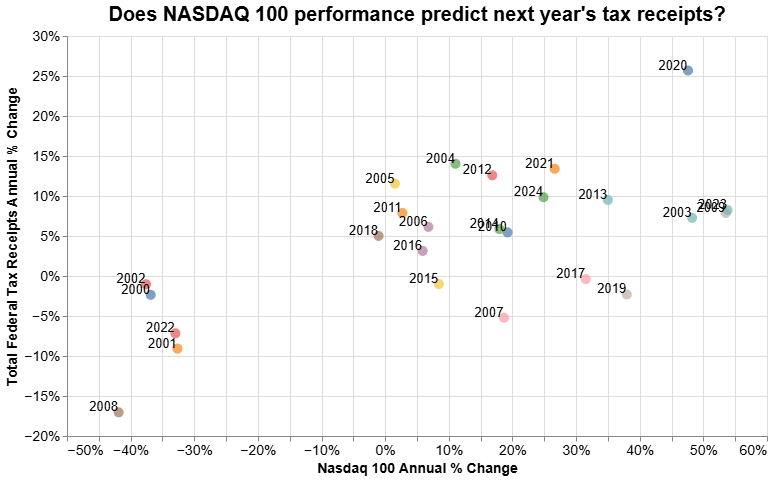

Perhaps the most interesting observation is how often the months leading up to a significant April-spike in TFR seem to exhibit a declining equity market (as shown here by the Nasdaq 100). This pattern is observed in 2020, 2021, 2022, modestly in 2023, 2024 and dramatically in 2025. One explanation for this might be that as taxes are paid and money flows into the TGA, it exits the banking system and thus reduces banking reserves and effectively drains liquidity out of the monetary system. This is particularly pronounced in the tax season following a year of significant equity gains. It is interesting to note that in 2020 the tax deadline was postponed to July 15 due to the Covid outbreak, announced on March 21. This happened again in 2021 and was announced on March 17 that year. As a result the April-spikes are not so pronounced. This same pattern can be summarised somewhat differently as below, for a longer horizon. The chart compares annual Nasdaq 100 performance with the % change in annual tax receipts. The relationship is particularly pronounced during years where the equity market has declined significantly (e.g. 2000-2002, 2008, 2022).

We are not the only ones evaluating this. The Federal Reserve was sufficiently concerned about a liquidity drain running up to this date that it restarted buying US treasuries. We are also curious whether the strong performance of equity markets in 2025, combined with the dramatic rise in certain assets already in 2026 (e.g. precious metals), will exacerbate this phenomenon. Given that some of the realised gains from 2025 might have been redeployed already (which means they would need to be sold again, if some of the proceeds had already been earmarked for tax payments), we also wonder whether this could lead to some downward pressure on equity markets going into April. What lies ahead? Here we’ll float some ideas, in increasing order of drama, in which either the liquidity drain could be averted/postponed and/or the potential financial market impact reduced:

We believe that President Trump does not want the current equity market rally to end and that this period is known for financial market instability. So it seems likely that one of these or another tool may be used to keep the liquidity flowing. But until we see something like that happening - what do we say to the death of the dollar? Not today. And if the US dollar starts to rally dramatically from here, it goes without saying that everything priced in US dollars is going to be in for some turbulence. We’re looking at you, silver, and at you, USDJPY. Software as a service1 (as an economic indicator) - 25 Jan 2026

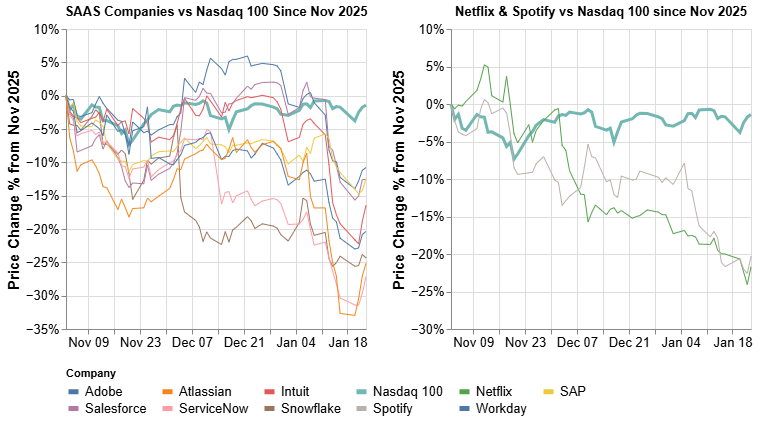

1Stock data from Yahoo! Finance Software-as-a-service companies have experienced a bloodbath in share prices over the last year. One of the main reasons given for this is that many people seem increasingly of the opinion that software has become a commodity that can be much more easily produced with LLMs. They are quick to declare “SAAS is dead”. There are critics of this view, and we resonate with some of them. Just because some of these tools are easier to build (or rather, prototype) does not mean they are easy or cheaper to maintain and internally developing anything means that the cost is brought forward, whereas with SAAS it’s spread over time. An alternative explanation for the decline of SAAS is as follows: many software companies are often initially valued at very high revenue multiples for a long time because of the expectation of significant continued market share growth and earnings in the distant future, because of “winner takes all” dynamics in this business. However as more competitors join the market, market share growth plateaus, and the expectations of significant future growth for each individual company diminishes. So instead of being valued like a company that will have a 60% market share in the future, it may be closer to e.g. 20% or 30%. If this is why SAAS companies have tumbled - that the total addressable market was either smaller than expected, or each of these companies’ relative control of this market was overestimated, then it seems unlikely that SAAS companies will recover quickly (or ever) to their recent highs. Caution warranted. A third potential reason for why SAAS companies are down is that subscription-as-a-service is struggling. This could be because of subscription fatigue and/or cost-cutting drives. We think of SAAS expenditure as a barometer for overall recurring corporate expenditure. And if this is being tightened, this may not bode well for the business cycle and perhaps for equities more broadly. This could also explain weakness on the consumer side, with video-streaming companies like Netflix and music-streaming companies like Spotify performing poorly since the end of Q2 2025 and particularly since November. It might be useful to consider online payments processors like Paypal, Block and Adyen in this equation as well and so Paypal's earnings call on the 3rd of February will be closely watched. In conclusion we think SAAS might be down (beyond broader market movements) for one of three reasons:

In our view only if reason 1 explains the weakness then we believe SAAS companies could be worth more investigation. If either of the other two explain it, more caution is warranted. Another week of tariff escalation? and Intel (again) - 24 Jan 2026US President Trump has potentially set the stage for some more tariff conflict this week, tweeting that Canada would face 100% tariffs if it signed a trade deal with China. This is a rather sharp u-turn from what seemed like approval of such a deal a week ago but is perhaps in response to Prime Minister Mark Carney’s speech at Davos. The deal in question would see Canada import around 50 000 electric vehicles from China at a tariff of 6.1% instead of 100% and Trump is worried about Canada (and Mexico) being effectively used as “transshipment” hubs to skirt US tariffs on China. Canada’s EV sales have plunged in recent years. One outcome of this escalation could be a deal between the US and Canada on EVs and we imagine this could be positive for US electric vehicles manufacturers like Tesla or Rivian (in which we hold a position). In the very near term, markets could react negatively again. Especially with the threat of shutdown looming large again after another US citizen was fatally shot in Minnesota. It is interesting to see this trade escalation, impacting Canada but clearly directed at China, happening in parallel with what appears to be a somewhat softer tone in the recent National Defense Strategy document, posted on Friday. The document emphasises that the US would “deter China through strength, not confrontation”. This “walk softly and carry a big gun” approach is less aggressive than in the past which is noteworthy given reports that President Xi Jinping is further consolidating his power over the People’s Liberation Army. And on South Korea it noted, under the heading of “Line of Effort 3: Increase Burden-Sharing with U.S. Allies and Partners, that it was “capable of taking primary responsibility for deterring North Korea” and that US support would be “more limited”. It is at this point worth noting again that North Korea may be sitting on the world’s largest reserve of rare earths. The importance, and surging prices, of these materials could cause a re-escalation of tensions between North Korea and South Korea and could rouse the interest of both China and the US. This somewhat conflicting messaging - explicitly anti-China on social media, but significantly more reserved in official documentation or positions like the NDS - begs the question - where should we look for the truth of President Trump’s attitude towards allies and competitors alike? We are beginning to think sometimes the tweets and other social media appearances might be part of an overall negotiating tactic, and that the truth can be gleaned from his statements at large live events, or wider forums, as with his recent Davos appearance. We were firmly of the view that Trump would not use military force with Greenland and were vindicated in this view. And we think Trump will similarly reach a deal with Canada. Intel We highlighted 3 potential reasons why the US government might want stakes in certain companies like Intel. The 17% decline suggests that reason 3 might have more to do with the logic than we initially thought - the cited WSJ article byline reads "...troubled chipmaker reminded investors why it needed a bailout in the first place” (our emphasis). Brutal. The article goes on to mention that Intel had spent months cutting capacity on older production lines and therefore were unprepared for a surge in orders for older processors. This seems like a spectacular own-goal, with the only real defence being something along the lines of “this is going to be a long process - be patient”. Between that and potentially laying off 25 000 of its employees, it has some similarities with Stephen Elop’s tenure at Nokia. If Intel’s Arc GPU doesn’t perform well, it would seem that the major beneficiaries of Intel’s policy at the moment are its competitors AMD and Nvidia. Indeed at the moment the real winners are investors who bought Intel stock near the ~$18 lows in April 2025 (the US government being one of them). The other direct winner is of course Nvidia which announced a ~4% stake in Intel in a deal that was completed in December 2025. This stake which cost $5 billion at the time was made at around $23.28 per share. By the end of Q4 Intel was priced at $37 per share or a gain of nearly 70% around $3.5 billion. If Nvidia treats it as a fair value investment for accounting purposes (instead of equity, which is more common for larger stakes and associated with strategic control), it could show up as an unrealised gain and boost Q4 earnings by ~$3.5 billion. This would be reminiscent of Amazon’s Q4 2021 earnings being boosted dramatically by its stake in Rivian at the time. Unfortunately that did not turn out so well for Amazon in the end. We hope, for everyone’s sake, history does not rhyme for Intel. We bought some again at around -15% down on the day after their earnings were announced. After plunge US Egg Prices are up 120% in a week - 23 Jan 2026

Data from: Trading Economics Farmers have been struggling in recent years. In the US, farmers are facing $44 billion in net cash income losses across corn, soybean and wheat for their 2025-26 crop due to rising input costs, lower crop prices and trade war impacts. There are similar stories in Europe. And in the UK, a report found that farming was no longer profitable for the average farm. This could pose risks to the future supply of food. Food is one of the many things we’ve become accustomed to importing and therefore for which we have enjoyed lower prices. In a less collaborative world, it may become more important to be able to produce food domestically. The US relies on imports for roughly 20% of its food, and the UK about 40%. Covid-related supply chain disruptions showed us what can happen to the price of various foods during extreme events. When prices in a market fall significantly, the less efficient producers either go out of business, get acquired, or get subsidized. In many such cases market concentration will rise which increases suppliers’ pricing power, which can lead to price increases later. And given that agricultural commodities’ supply are significantly affected by the weather, which is effectively random (or very hard to predict) at long time horizons, their prices can move in cycles punctuated with shocks. A good example of such a product is eggs in the US. The price of eggs, as shown above, spiked dramatically during Covid and again even more so during the HPAI outbreak in 2024 and 2025, reaching $8 per dozen. Since then, the price collapsed to $0.33 per dozen, down nearly 96% from the peak. When adjusting for inflation, as far as we can tell this is the cheapest eggs have been since 1990 possibly ever. This is likely due to a reduction in the avian flu cases, some amount of demand destruction at such high prices, and a reduction in overall calorie consumption as well as that of many baked goods like cakes (due to Ozempic). This excellent article by the St Louis Fed discusses the market for eggs. Some of the listed egg producers in the US (Cal Maine Foods and Vital Farms) have seen substantial declines in their share prices since August 2025, by which time the collapse in egg prices was well underway. Perhaps this suggests that their earnings are not so sensitive to declines in prices or perhaps there hasn’t been enough time for that effect to pass through. Egg prices have now fallen to a level such that many consumers will a) be able to afford them and b) may be less sensitive to even large percentage increases in their price. This presents a potentially asymmetric opportunity for egg producers and their equity stocks. Egg prices are clearly very volatile. But 120% in a week is a staggering rise. Whether we saw the bottom in prices is uncertain but at this rate it is one of the cheapest sources of protein - $0.33 for ~ 80 grams of protein or $0.004 per gram is incredible. And this will likely not last. We have taken a position in Cal-Maine Foods and are evaluating Vital Farms as well. There is one important caveat. In a lawsuit filed originally in 2011, Cal-Maine, along with other producers, were found guilty of conspiring to limit egg supply to raise prices between 2004-2008. Beyond the moral outrage at fixing the price of a staple protein, we are also concerned about a repeat of this outcome with potentially far more significant damages. Several class action lawsuits accuse egg producers and a particular media company (formerly Urner Barry Publications, now part of Expana) of participating in price fixing behaviour. Under the Trump administration there has been an increase in antitrust investigation into agricultural producers, including egg producers. We might just be counting our eggs before the producers have chickened out. Question for the future

The new widomaker trade? - 22 Jan 2026

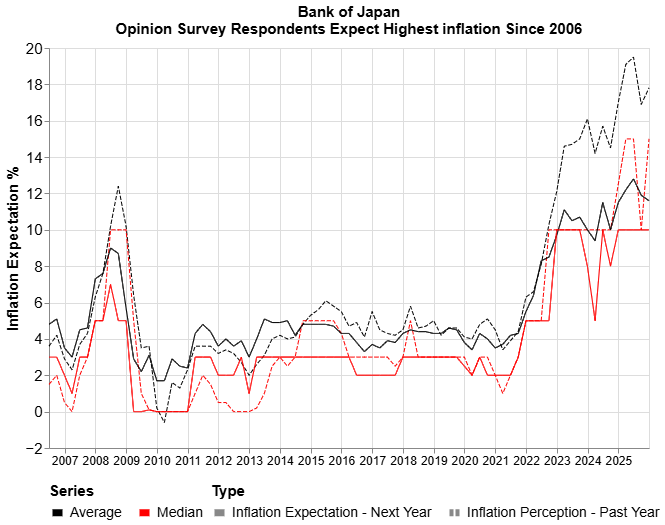

Opinion Survey Data from: Bank of Japan The Bank of Japan (BoJ) is announcing its interest rate decision soon. Markets seem to expect them to hold rates steady at 0.75%. With a chart looking like the above, for the BoJ to do that either means we misunderstand something, or they are ignoring their current survey respondents. These respondents said they expect inflation to average 10% per year for the next 5-years. Expectations are the highest since they began collecting this survey data, and the last time it was this high was just before the Global Financial Crisis. And they do not seem to be budging lower. With Japanese Government Bond (JGB) yields at skyhigh levels, the BoJ can’t really afford more inflation but they also might not be able to afford an interest rate hike and the ensuing impact. They are between a rock and a hard place and if they hold rates as the market seems to hope and consumer inflation expectations do not start to come down rapidly they might be in trouble. Will they really tolerate such high consumer inflation expectations? Is it just a matter of time before those expectations translate into wage negotiations? In the past, the widowmaker trade was to be short JGBs. In the last couple of years, that has been flipped - and shorting JGBs has been one of the best trades available. Perhaps now we’re about to move into a regime with such volatility in these instruments that participating in the market at all could be the new widowmaker trade, especially on the very long maturities like 30-year or 40-year bonds. Bloomberg noted that a mere $280 million of trading volume in the long-dated bonds caused much of Japan’s bond market ructions this week. On an unrelated note. Intel’s disappointing performance after earnings is somewhat worrying. Does this mean anything for the portfolio of companies that the US government has invested in? We were at least vindicated in our begrudging decision to sell the remainder of our Intel portfolio. Or is this a buying opportunity and possibly the last time you could get Intel at that price? TACOs at Davos, and Intel - 21 Jan 2026

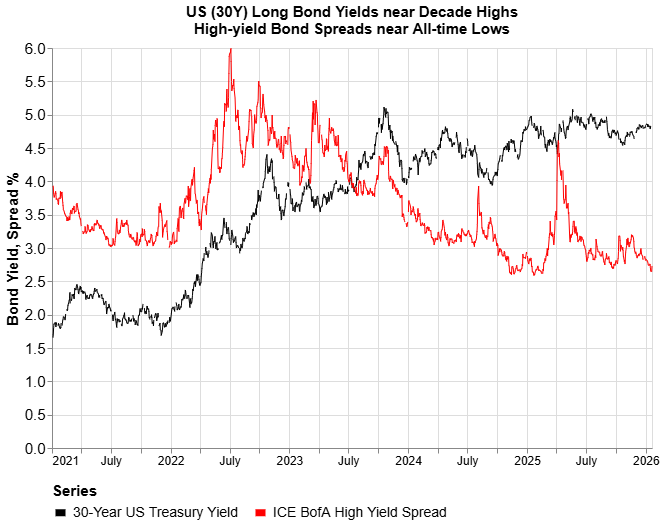

Bond yield and credit spread data from: St Louis FRED President Trump delivered a one-two market-boosting combo from Davos today - first indicating that he would not use force to take Greenland (as we suspected), and second taking tariffs off the table because of the prospect of a “Greenland deal” that arose from negotiations with NATO’s Mark Rutte. We’re somewhat surprised by the extent of the apparent climbdown and markets were clearly bursting for this good news - with the NASDAQ 100 ripping from the day’s low of 249 to a high close to 255, an intraday range of nearly 2.5%. We won’t go so far as to point out the things that can be purchased with such a gain in US equity market cap… We are hesitant to trust the rally today. It smells a bit like a short squeeze. It seems unlikely that uncertainty around Greenland and associated tariffs is over and if not, there’s more market volatility to come. If it is over, we worry about the credibility of President Trump’s threats, more specifically the loss thereof, if he is seen to have climbed down so quickly. If he can no longer inspire fear and awe with threats around tariffs, we are concerned about the tools he may resort to in order to achieve his goals. Arguably, this time around he already resorted to threats beyond tariffs in the shape of potential military force. Equity markets are an important metric for Trump. And we’ve seen in the past how he was willing to tolerate a certain amount of pain in equity markets, which added to the credibility of his threats. So the worry is that their current lofty levels mean there’s a lot of ammunition left for him - he can make wild statements and threats and afford to sit back amid the ensuing market chaos (and, effectively, implicitly, take credit for whatever market swings apparently result from his threats). One caveat we have here is that it might not be equity markets that prove to be the limiting factor. The 30-year US Treasury Yield is sitting at around 4.8%. This is close to the pain threshold of 5% that we’ve seen the yield retreat from a few times this year, coinciding in April with dramatic tariff climbdowns or deals. And with the additional threat (although ludicrous and self-immolating, in our view) of European funds dumping US government bonds looming above him, perhaps Trump pulled back so quickly because we were already close to the pain threshold in long term yields. If this was the thinking, then this equity rally probably has some more legs. Another risk factor worth looking at again are credit spreads which we covered shortly before the tariff meltdown in April 2025. Junk spreads are very close to the Jan 2025 lows (2.65 yesterday vs 2.59). And therefore, close to all-time lows. Does the market really believe, at the moment, that junk-rated companies are at the lowest risk relative to investment grade companies, ever? This seems a bit optimistic, especially with the redemptions that have been happening in private credit. As a result we’re liable to interpret this number as something of a floor - it is unlikely to go much lower, and when it does go up, it tends to be paired with market turmoil. Indeed today it did spike 8 basis points, an increase of around 3% or in the 93rd percentile of daily changes. Not great, not terrible. But if your dosimeter only reads 3.6 roentgen, then maybe you should check your dosimeter. IntelOn a somewhat unrelated note, Intel is reporting earnings tomorrow evening. We exited the remainder of our Intel position today and are already sad about what seems to be the inevitable rip higher. What if it’s another Oracle-type earnings call and this multi-hundred billion dollar company simply goes up 40% after hours? This earnings call could be a bellwether for a few things - US semiconductor manufacturing, as well as, perhaps more importantly, what happens to companies in which the US government takes a stake. If Intel earnings disappoint, could it mean something bad for the other companies the government has taken stakes in? The US has made investments in several listed and even private companies including recently a private alumina (and gallium) producer. And we’ve been trying to determine what variant of late-stage capitalism or statism this really is: does the government want stakes in these companies because